Deepfakes Are Coming for Small Business: How to Protect Your Team

⚡ Check your Deepfake Risk Level now

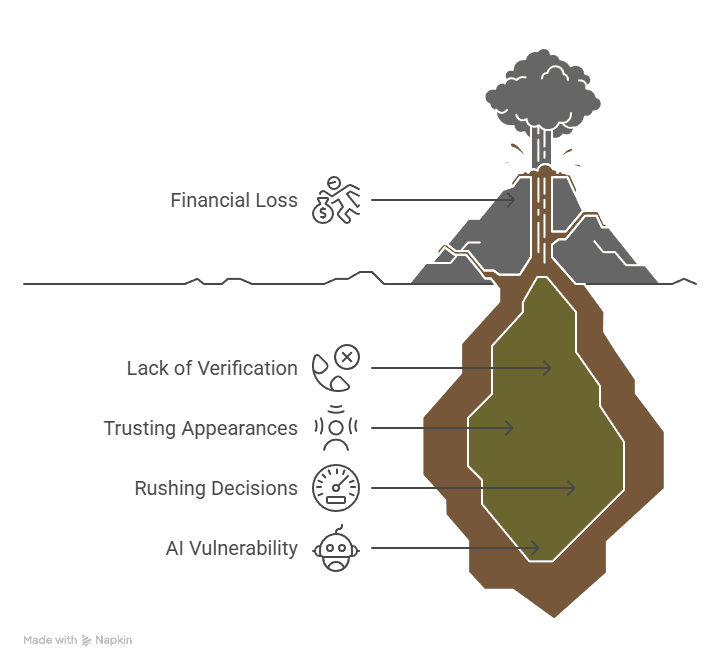

You get a call from “yourself.” Same voice. Same urgency. “Wire this payment now; we are about to lose the deal.” Your bookkeeper does not question it. The money is gone in minutes. This is not a tech demo. It is happening right now to small businesses because AI makes fakes convincing and cheap. If you are moving fast and skipping formal checks, you are exactly who they are targeting.

AI-powered deepfakes threaten small businesses.

Why Small Businesses Are Prime Targets for Deepfake Scams

Small businesses have become a favorite hunting ground for AI-enabled criminals. Unlike large corporations with compliance teams and layered approval processes, small businesses often move fast and rely on trust. That makes them vulnerable when a scammer shows up with a voice or face that sounds exactly like the owner.

- Public content is everywhere. One podcast interview or Instagram story can give scammers enough voice samples to create convincing deepfakes. Learn why controlling public AI content matters.

- Lean teams skip formal processes. Many owners do not require multiple approvals for payments or credential requests.

- Security budgets are tight. Voice verification and deepfake detection tools are often missing. Explore how AI advances affect security.

- Fast decision culture. Small teams pride themselves on speed, which criminals exploit to push urgent requests.

Stat: Deepfake-related scams cost companies more than $25 million in 2024 (FTC), a 320% jump from the year before. Criminals know small businesses lack the security of big corporations, making them easy prey.

Real Deepfake Scam Examples You Should Know

Here are a few documented cases that show how dangerous and convincing these scams have become:

- A finance employee wired $24,000 after a fake “urgent” video call from the boss. The call looked real because the attacker had cloned the CEO’s face and voice from public videos.

- Attackers used cloned voices to request password resets from IT help desks, convincing staff to hand over access to sensitive systems.

- A small e-commerce brand nearly leaked its entire customer list after a fake supplier call claimed to be from a trusted partner.

These are not hypotheticals; they are real reports from companies with fewer than fifty staff. The trend is accelerating as the tools to create deepfakes become cheaper and easier to use. See how AI tools evolve in small business.

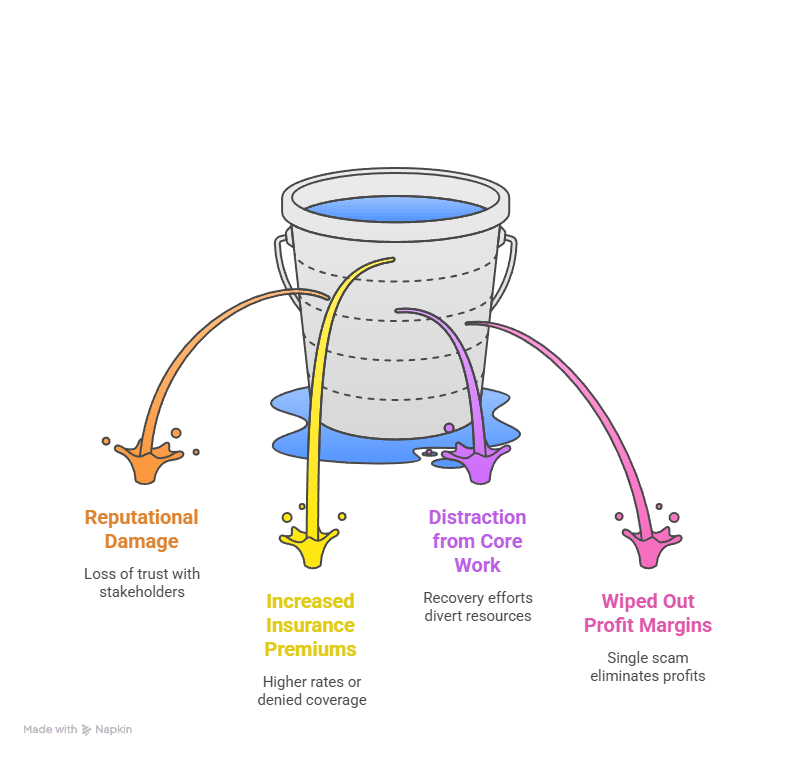

The Financial and Reputational Cost of a Deepfake Attack

The immediate loss of stolen funds is bad enough, but the real cost goes deeper. Public stories of being fooled by a fake CEO or leaking customer data damage trust. Clients and partners begin to wonder how secure your company is. Insurance providers may raise rates or deny coverage. Recovery can take months and distract from core work. Understand AI risk management here. Even a single successful scam can wipe out profit margins for the quarter and harm your reputation with customers and suppliers. Once trust is shaken, it takes far more time and money to rebuild than to put simple safeguards in place today.

Data breaches drain small businesses like a leaking bucket — causing reputational damage, higher insurance premiums, distraction from core work, and wiped-out profit margins. Learn how to plug the leaks before they sink your business.

How to Protect Your Small Business From AI Deepfake Scams

1. Use Callback Verification

If anyone requests money, passwords, or access, hang up and call them back on a known number. Make it company policy and practice it with your team so it becomes automatic. Build workflows that enforce verification.

2. Require Dual Approval On Payments

Even a small delay is worth it. A second set of eyes stops most urgent scams and makes it harder for attackers to pressure a single employee. Automation can support dual approval systems.

3. Train Staff On Deepfakes

Show real examples. Teach your team to spot odd pauses, mismatched lip movement in video, or rushed emotional language. Awareness turns employees from the weakest link into the first line of defense. Training is key to safe AI use.

4. Lock Down Sensitive Voice And Video

Review what you publish online. Limit clear audio or video of owners and finance leaders when possible. Even a few seconds of clean audio can be enough for a convincing fake. Think strategically about what media you share.

5. Use Multi-Factor Authentication Everywhere

Even if attackers get a password, MFA blocks most unauthorized logins. It is one of the simplest, most cost-effective ways to stop breaches. McAfee says that data suggests that you’ll encounter deep fake today.

6. Create an AI Acceptable Use Policy

Make sure employees know what is safe to share with AI tools and what is not. Clear boundaries reduce the risk of confidential data being used to train external systems or leaked in prompts. See how AI policy shapes safe adoption.

The Bigger Picture: AI Creates Opportunity and Risk

AI creates massive opportunity, but it also creates a new attack surface. Many small businesses wait until after a hit to build safeguards. That choice is expensive and reputation-damaging. A smart AI strategy is not only about productivity. It protects the company you have built from modern threats and keeps your data, cash flow, and brand reputation safe. You can move fast and stay innovative, but only if you have guardrails in place. Learn how to integrate AI safely.

Small businesses can move from vulnerable to secure by building safeguards and integrating AI safely. Protect your data, cash flow, and brand while staying innovative.

First 30 Days: Quick Defense Plan

- Week 1: Set a company-wide rule for callback verification on all money or credential requests.

- Week 2: Turn on multi-factor authentication for all accounts.

- Week 3: Host a 30-minute training showing staff what deepfakes look and sound like.

- Week 4: Review what audio/video of leadership is online and remove or limit where possible.

Next Move For Smart Owners

Do not wait until a fake version of you drains your account. Secure your business and stay innovative by combining AI adoption with security strategy. See how small businesses are doing it.

Frequently Asked Questions About Deepfakes & Small Business Security

What is a deepfake scam?

A deepfake scam uses AI to clone someone’s voice or face to trick employees into wiring money, sharing passwords, or giving away sensitive data. Automation can help safeguard against fraud.

Why are small businesses targeted?

Attackers know small teams move fast, often skip multiple approvals, and rarely have advanced security tools in place. See how small teams can use AI safely.

What is the first step to get protected?

Start with clear payment verification rules, train your team on deepfakes, and add multi-factor authentication to all key accounts. See how workflow clarity improves security.

Can AI security fit small business budgets?

Yes. Most first-line defenses such as training, policy, MFA, and call-back verification are low-cost but high-impact. Practical steps keep costs manageable.

How fast are deepfake scams growing?

Reported incidents are increasing every quarter. A McAfee report in April 2025 noted that deepfake-enabled fraud caused over $200 million in financial losses in just the first quarter of 2025.